does texas have an inheritance tax in 2020

Twelve states and the District of Columbia collect a state estate tax as of 2021. As a beneficiary you do not normally need to do anything.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

The federal government also has an estate tax but it does not collect an inheritance tax.

. Even though no state inheritance taxes are imposed some estates are subject to federal estate taxes. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. You can give a gift of up to 15000 to a person without having to pay a.

For instance in Iowa a surviving spouse parents. This is because the amount is taxed on the individuals final tax return. There are not any estate or inheritance taxes in the state of Texas.

Therefore if you inherit possessions property to sell or keep or money from a loved one in Texas you most likely wont need to pay any tax. T he short answer to the question is no. The state of Texas does not have an inheritance tax.

Some people include provisions for inheritance tax in their wills to spare their beneficiaries that tax burden. Finding Information About Taxes On Interest An initial gift of money or property is tax-free but if. There is a 40 percent federal tax however on.

The big question is if there are estate taxes or inheritance taxes in the state of Texas. Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024. However other stipulations might mean youll still get taxed on an inheritance.

Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. The executor or administrator named in the will and appointed by the court gathers the property pays the debts of the estate and distributes the property to the beneficiaries. While most states in the United States have an inheritance tax Texas doesnt.

Your 2020 tax returns. However in Texas there is no such thing as an inheritance tax or a gift tax. Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax.

Do you have to pay taxes on inherited property in Texas. State inheritance tax rates range from 1 up to 16. Surviving spouses are always exempt.

In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. The tax did not increase the total amount of estate tax paid upon death. Gift Taxes In Texas.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. There are no inheritance or estate taxes in Texas. In Texas as well as nationwide if you are a named beneficiary of an individual retirement arrangement commonly referred to as an IRA then your share of the distribution is added to your ordinary income and will be taxed at your personal income tax rate.

First there are the federal governments tax laws. The short answer is no. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year.

Estate and inheritance taxes are burdensome. Some family members wont have to pay inheritance tax at all. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation.

Often however the estate will pick up the tab. In the Tax Cuts and Jobs Act of 2017 the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires December 31 2025. However if a loved one gifts you something elsewhere in the country you may need to pay that states inheritance tax.

There is a big exception to the no inheritance tax rule however. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

Rather a portion of the federal estate tax equal to the allowable state death tax credit on the federal estate tax return was deducted from amount due to the federal government and. For deaths that occur. Before 1995 Texas collected a separate inheritance tax called a pick-up tax.

But there is a federal gift tax that people in Texas have to pay. Does Texas Have an Inheritance Tax or Estate Tax. Claiming an inheritance in Texas is usually straightforward if you are a named beneficiary in the will.

There is no federal inheritance tax but there is a federal estate tax. New Jersey finished phasing out its estate tax at the same time and now only imposes an inheritance tax. While Texas doesnt have an estate tax the federal government.

In 2021 federal estate tax generally applies to assets over 117 million. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

How To Avoid Estate Taxes With A Trust

States With Highest And Lowest Sales Tax Rates

Want To Invest In Emerging Markets Today The Rate Of Return On Foreign Investment In Africa Is Higher Than In Any Investment Accounts Investing Infrastructure

Talking Taxes Estate Tax Texas Agriculture Law

Texas Estate Tax Everything You Need To Know Smartasset

How Inheritance Became A Gift A Necessity And A Curse In 2021 Inheritance Money Wealth Transfer Inheritance

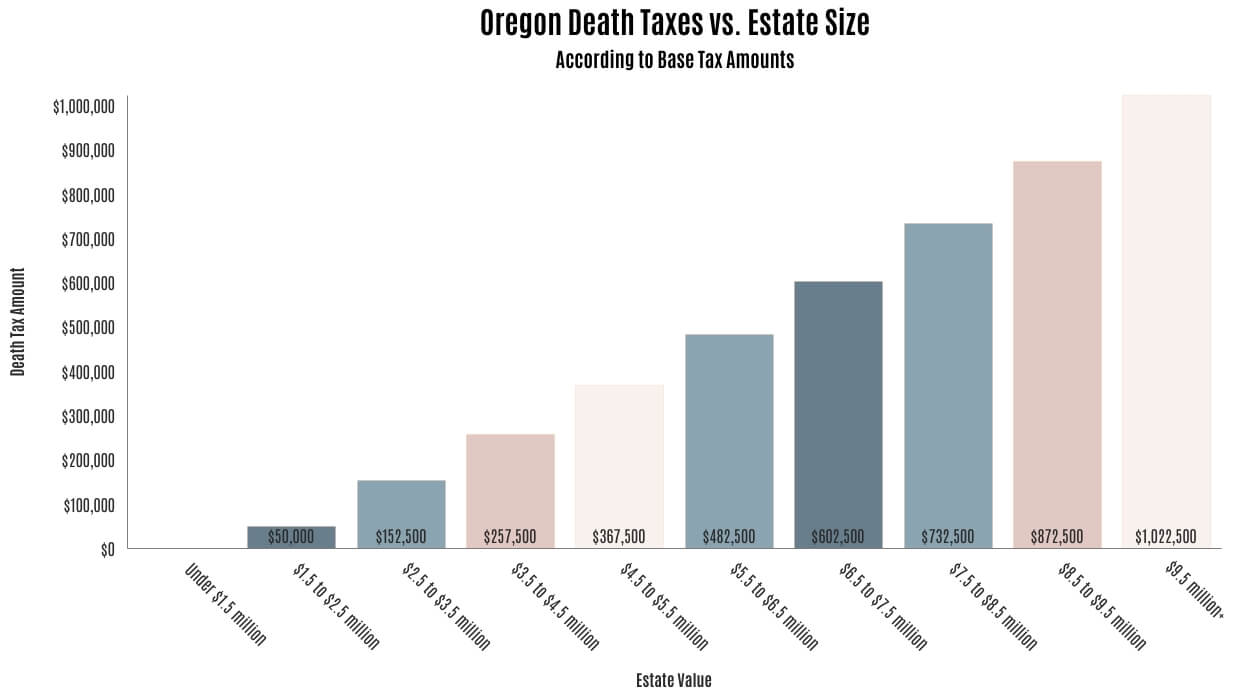

Death Taxes In Central Oregon De Alicante Law Group

Eight Things You Need To Know About The Death Tax Before You Die

W10 Form 10 What Will W10 Form 10 Be Like In The Next 10 Years Rental Agreement Templates Doctors Note Template Tax Forms

![]()

Want To Invest In Emerging Markets Today The Rate Of Return On Foreign Investment In Africa Is Higher Than In Any Investment Accounts Investing Infrastructure

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is There A Federal Inheritance Tax Legalzoom Com

Texas Inheritance And Estate Taxes Ibekwe Law

Do I Have To Pay Taxes When I Inherit Money

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Make Your Own Will And Testament In Texas Will And Testament Last Will And Testament Writing

States With No Estate Tax Or Inheritance Tax Plan Where You Die